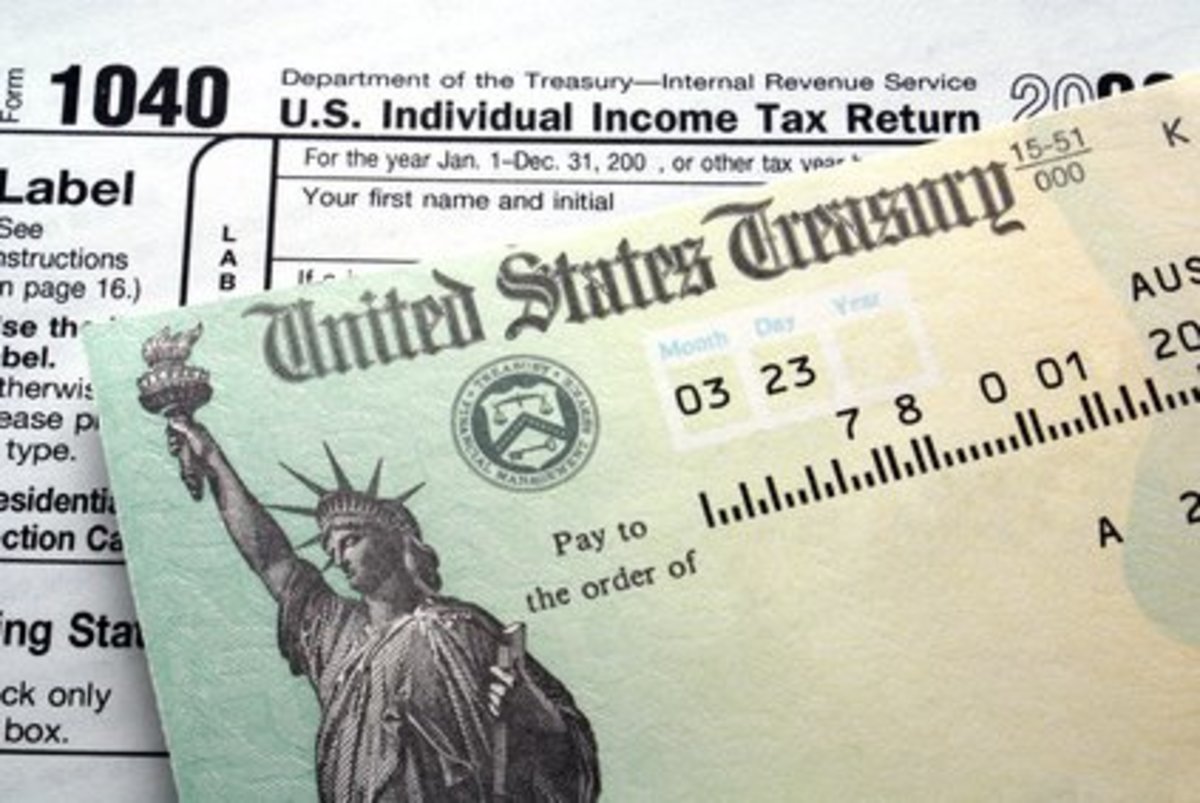

Tax Refund Advance Money

Tax Refund Advance Loans

Many tax preparation companies will offer a tax refund advance to their consumers. Well known companies like Liberty Tax Service and Jackson Hewitt advertise these advances in their television ads. These tax advances are actually loans. The loans are based on the amount of one's tax return filing. These tax advances can be detrimental to the cash needy tax filer.

Moneys given as tax refund advances are loans that are not actually given by the company that prepared your taxes like Liberty Tax Service. Tax refund preparers are not authorized to issue loans. The tax preparer must partner with a third party, a lending institution like a bank, such as American Financial Institution.

Tax preparers partner with banks to orchestrate these loans. By linking you with the lending institution the tax preparer is entitled to part of the moneys made on this loan. Banks charge hefty interest rates for advances on tax refunds. The loans are basically unsecured except for the anticipated tax refund check. They are not guaranteed by an asset which can be attached if the refund check fails. Thus, interest rates on these types of loans can be significantly higher than regular bank loans.

Are These Loans Good For You?

Tax refund loans come at a premium. Often times the rates are as much as 33% APR. Credit card companies which are notorious for having high interest are often lower than these loans. (Most credit card companies average between 22%-25% APR on the unpaid balance and with credit card companies you usually get a grace period of 30 to pay in full without an interest charge.)

There have been law suits settled over the misrepresentation of advance refund loan advertisements. These ads have been found to be misleading to the unaware consumer. Be sure to understand all the terms of your loan prior to signing any contracts.

Impatient tax refund waiters, who want their money early, pay a premium price for it. In addition to the fees for an advance on their anticipated tax refund, these individuals often pay a fee for having their checks cashed. Check cashing fees for these individuals are estimated to be around 205 million dollars in 2004.

It is nice to be available to walk out of the tax preparer's office with money. As mentioned earlier in this article, there is a cost associated with this convenience. In addition these these absorbent costs, there are other dangers to be aware of.

If your actual tax return is less than the anticipated amount, you may not have enough money to cover the advance you took on your tax refund. If this happens, you are still responsible for the balance of the loan. Tax refund amounts can be affected by liens filed against your future tax return, unpaid child support, unpaid student loans, and tax preparer error.

Before filing for an advance on your pending tax return, be sure to consider all of the factors that come into play. It can be a very costly adventure and you may end up owing money in the end. It is probably wise to wait until you have the tax return in your hand before you start spending it.

![TurboTax Home & Business 2016 Tax Software Federal & State + Fed Efile PC download [Amazon Exclusive]](https://m.media-amazon.com/images/I/41XyyRAOw0L._SL160_.jpg)